Father Name Mismatch In Pan Card

Sir ihave lost my pancard.

Father name mismatch in pan card. This card may be used in a lot of financial and other transactions by an indian citizen. I am unable to verify my pan details in uan provident fund portal due to mismatch in name in pan card and uan. Passport authorites income tax etc. Further i am a non govt.

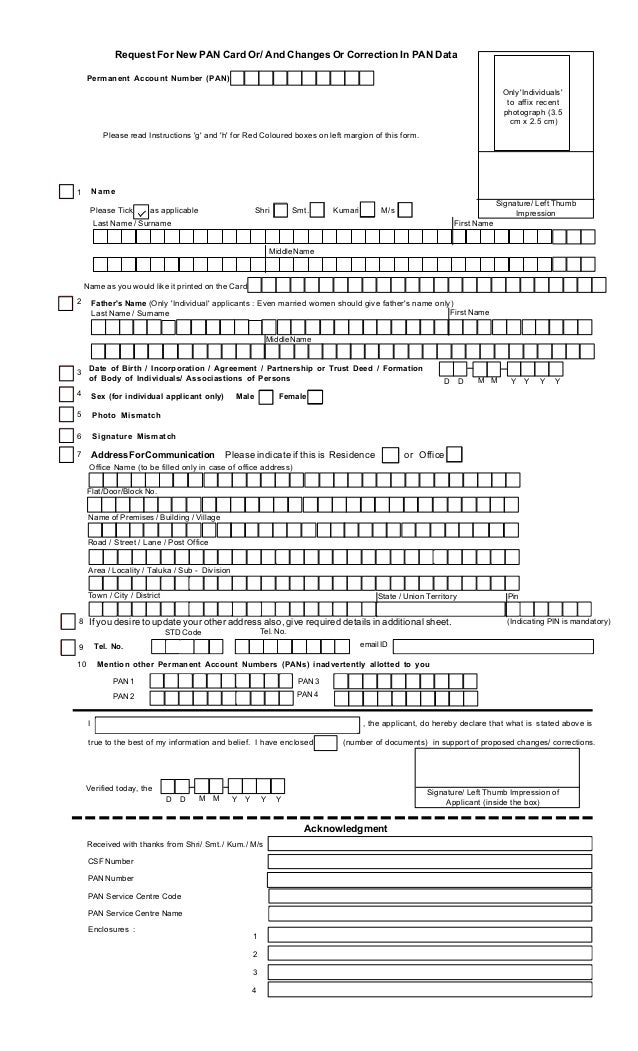

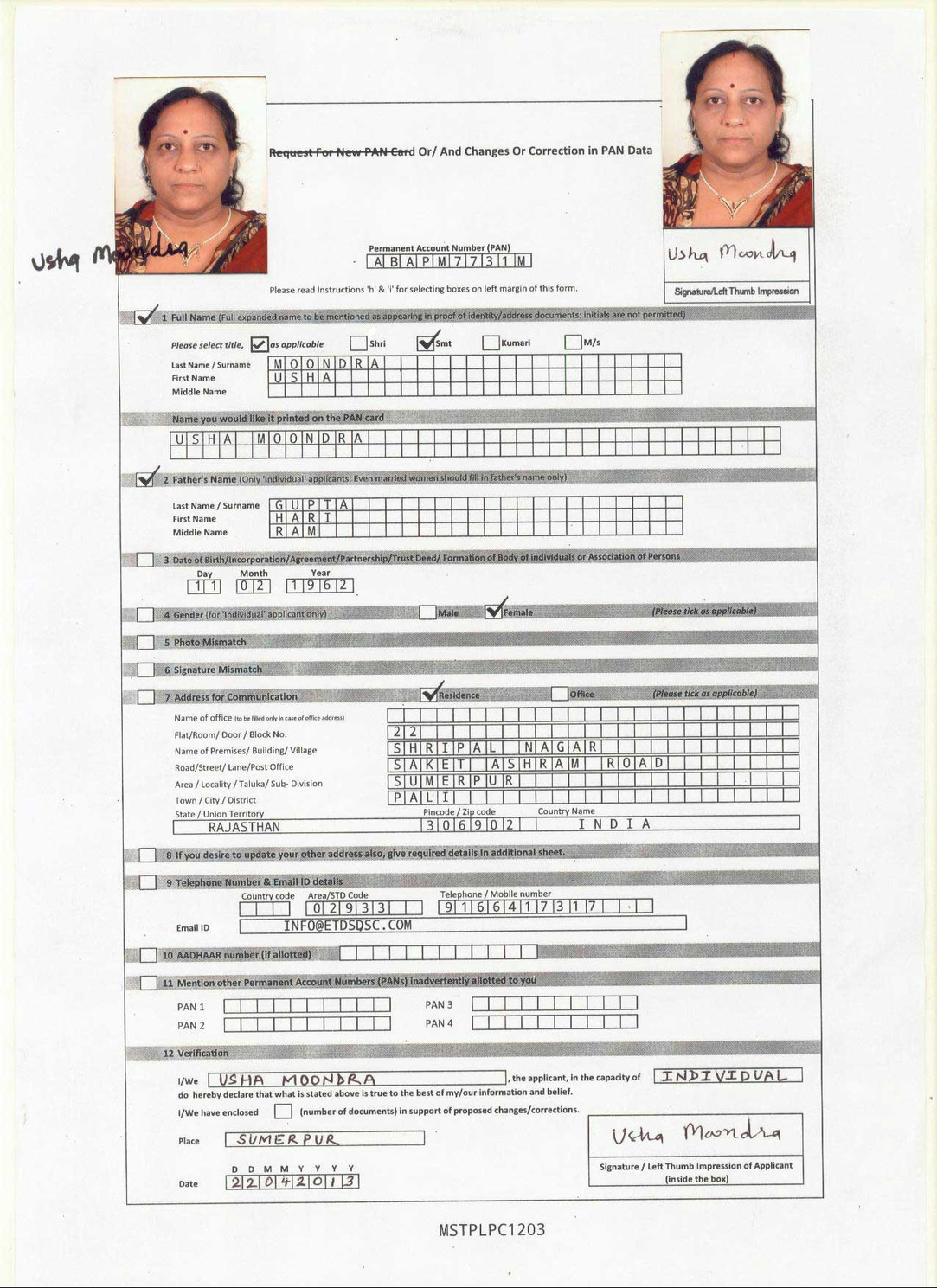

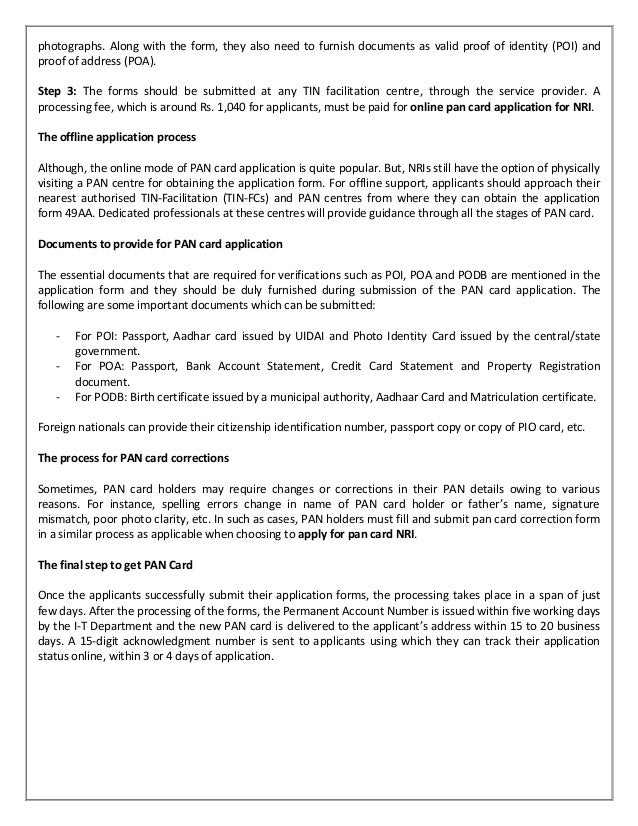

If you want to. Appropriate flag should be selected to indicate the name out of the father s name and mother s name given in the form to be printed on the pan card. Could you please advise on how can i update the name in pan first and last name are interchanged. Today we will tell you how to change father s name in pan card using this article you can request to make changes or correction in the father s name of pan card in case of incorrect father s name.

Andpd6313n father s name bhagwana ram dudi. Help me thanking you. Still my status in under ppc objection. Father s name change on documents.

There you will see pan details. Do not require any such publication. Married woman applicant should also give father s name and not husband s name. If you are trying to link your aadhaar card with the pan card but it is not happening you need to check details registered with pan and aadhaar cards.

Go to profile settings my profile after logging in to e filing home page income tax department government of india. Respected lawyers i want to correct my father s name on all my documents like pan card passport etc. Pan card father s name mismatch copun n protected pan no. The name of assessee is mentioned there in this format.

So how can i apply for a new one. I want to know is publication of such change is necessary in official gazette. And also iam not sure about my first name and surname on the pan card but know my account number. In a general issue regarding the mismatch in names occurring in the pan card and aadhaar card has been surging day by day as in the common process to link the aadhaar card to the tax return file the issue of name mismatch recurring in every taxpayer application as the government has mandated the linking of aadhaar card while filing income tax return easy guide to file income tax return for.

Hi the income tax website is updated. Pf dept reject my pf withdrawal form for mismatch my father name in aadhar my father name is bahadur singh pokhariya in pan card my father name is bahadur singh can pf dept reject my pf withdrawal form my pf no is 7 year old not uan no submit pf form by post i am not doing job any where now. Please advise what are the options to get the pan verified in uan. This is an optional field.

I had to know when i will get by pan card.